After reading this article, you’ll understand the use of a business checking account, what documentation is required to open one, and some of the timing considerations needed for planning your business launch.

Benefits of a Business Checking Account

There are several reasons to move from a personal account to a business checking account. Some reasons are related to convenience – separate tracking for tax purposes, protect your personal identity, and present a professional image for your business. Other reasons can drive opening a business checking account as a necessity. For instance, a business checking account is required to accept credit card payments, include partners, and increase allowable transaction frequency and amounts. Every business journey is unique. No matter what reason you find yourself researching business checking accounts, we have you covered with detailed analysis to make sure you are making the right choices fast.

Choosing a Bank

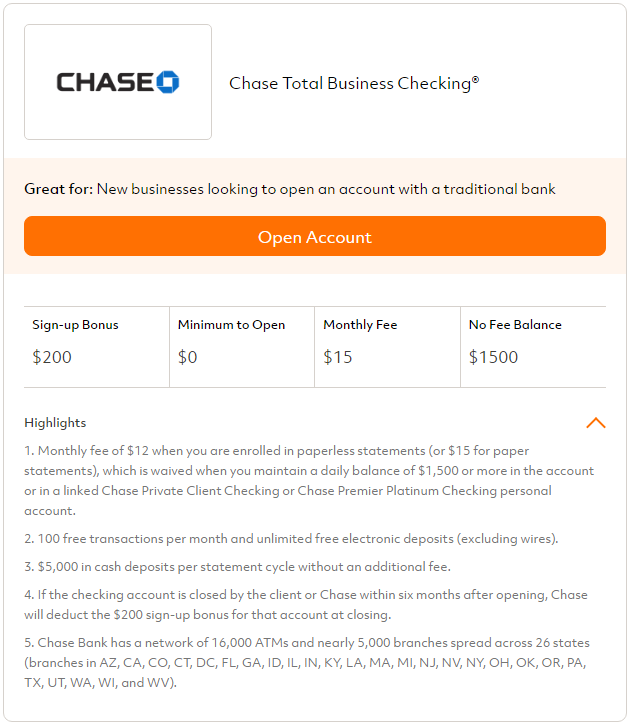

We found the Fundera article comparing the pros and cons of popular free business checking accounts particularly useful. After careful review, we selected Chase Bank Total Business Checking.

“If you run a growing but still a relatively small business, the Chase Total Business Checking might be right up your alley. This account requires a minimum daily balance of only $1,500 in order to avoid the $12 monthly service fee—which is still inexpensive in comparison to other checking accounts. The service fee is $15 if you’re not enrolled in paperless statements. The Chase Total Business Checking account also allows up to 100 monthly transactions without a fee, plus unlimited electronic deposits (excluding wires). You also get $5,000 in cash deposits each month without a fee. With more than 5,000 branches and 16,000 ATMS nationwide, this makes it very convenient to bank in person or online. Another nice perk is that if you have multiple business owners, each owner can get their own debit card, bank PIN, and online account access.”

Opening an Account

Before opening a business checking account, it is important to understand the required information.

As an example, Chase provides a checklist with the first and foremost item being all members are required to be present to open an account for a member managed LLC. Alternatively, any member who is unable to attend in person may fill out a Member Not Present form at a Chase branch and mail to the Chase branch where the account will be opened. Unfortunately, that process takes time. Therefore, whenever possible, plan to have all members visit a Chase branch together to open a business checking account.

The account creation process takes about an hour. Although not required, it is a good idea to schedule an appointment, or call ahead, because not all bankers may be business bankers, which can lead to extended wait times.

Timing Considerations

We know you’re anxious to get your business up and running, so it’s important to note the timing of receiving debit cards. Shipping debit cards typically takes about a week (data: 6 business days for Tech Efficient LLC). This is pertinent for multiple reasons, including that Apple does not allow use of a checking or savings account as a form of payment for the Apple Developer Program Enrollment fee.